Any individual who borrowed cash to attend a school owned by Corinthian Colleges – a for-earnings institution with a extensive record of defrauding pupils just before its sudden closure in 2015 – will have their federal scholar financial loans cancelled.

The mass discharge is the greatest amount of debt the federal government has erased in 1 action benefitting much more than a fifty percent million borrowers to the tune of $5.8 billion.

“When our steps these days will reduce Corinthian Colleges’ victims of their burdens, the Department of Training is actively ramping up oversight to superior safeguard today’s pupils from methods and make absolutely sure that for-financial gain establishments – and the businesses that possess them – in no way all over again get away with these types of abuse,” mentioned Schooling Secretary Miguel Cardona.

Corinthian Colleges opened in 1995. Dependent in California but with campuses nationally, the colleges shut in 2015 after the Education Section cut off the for-gain institution’s capability to entry federal funds. But borrowers who experienced attended the college sometimes nonetheless struggled to get their financial loans discharged.

The cancellation of the Corinthian School personal debt also arrives as the President Biden considers broader university student loan forgiveness, and payments on federal university student financial loans remain frozen. That pause is set to carry at the stop of August.

About 41 million borrowers benefit from the pause, and the Schooling Division has estimated it will save them about $5 billion a thirty day period.

Vice President Kamala Harris is anticipated to formally announce the personal debt cancelation on Thursday at the Education and learning Department. She has a background with Corinthian Colleges.

As the California’s condition lawyer standard, Harris secured a judgement against the institution that resulted in $1.1 billion in aid for previous students. The authentic grievance in opposition to the school alleged it focused bad Californians through adverts and advertising and marketing strategies that misrepresented the probability of college students obtaining positions.

The Training Office approximated that around 560,000 borrowers would be reward from the cancellation to the tune of practically $6 billion bucks. The cancellation will come via the borrower defense program, a federal initiative that cancels the personal debt of students who can establish they have been defrauded by their colleges.

Debtors with personal debt linked from Corinthian Colleges will not have to utilize for the reduction. And in some circumstances, they will get refunds for payments they had now built.

The agency has earlier declared modifications to present credit card debt relief plans that the office claims has resulted in $18.5 billion for about 750,000 borrowers. The most broad-reaching revamp was of the Community Services Personal loan Forgiveness application, which has benefitted nearly 113,000 debtors.

Borrower advocates praised the information, but questioned if the division would terminate debts at other shut for-income colleges.

“This action is extended overdue, but we hope it gives these borrowers with a clean begin and an possibility to chart a route to a brighter, additional protected money long run,” reported Libby DeBlasio Webster, senior counsel for the Countrywide Scholar Authorized Defense Community, a borrower’s advocate group. “We also hope today’s information is a indicator that other selections are on the horizon for 1000’s of in the same way located pupils who are ready for this variety of relief.”

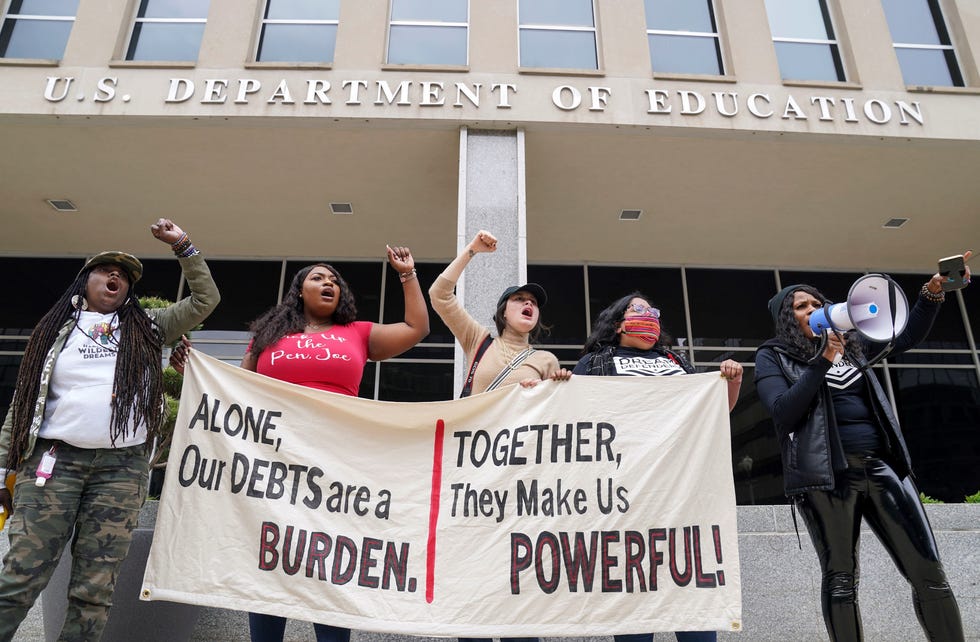

The Debt Collective, a nationwide group of organizers functioning toward scholar financial debt forgiveness, also praised the announcement. That team had also led a “university student financial debt strike” in 2015 manufactured up of former students from Corinthian College who claimed their levels have been fraudulent.

Thomas Gokey, a member of the Financial debt Collective, reported the borrower to defense rule was fairly unidentified until associates of the team commenced applying for reduction from the Instruction Office.

One particular of the customers of the unique credit card debt strikers — the group calls them the Corinthian 15—Latonya Suggs, reported on a press connect with Wednesday afternoon that she was encouraged by the cancellation, but wished it lined all debtors.

“I am happy at the conclude of the day that our loans are getting discharged, but the fight is not about,” Suggs claimed. “You will find way a lot more that we have to do. And at the end of the day, it took way too very long.”

More Stories

Make the Most of Your Education with Credible Student Loans

When You Let Customers Tell You What They Need, Everyone Wins

Berkshire Community College graduation gives the class of 2020, 2021 and 2022 a moment to shine on Tanglewood’s stage | Central Berkshires